If you don’t want to be paying off Christmas in January—and for many months afterward—you need a Christmas savings plan!

A Christmas savings plan will help you to have a debt-free Christmas.

There’s enough going on during the holidays without having to wonder how you’re going to pay for Christmas!

When you set money aside in your Christmas fund throughout the year, it helps you to save money on gifts. You can keep your eye out for great gift ideas and take advantage of sales and deals because you already have the money set aside to pay for them!

September might seem early to be talking about Christmas, but it’s only 4 months away!

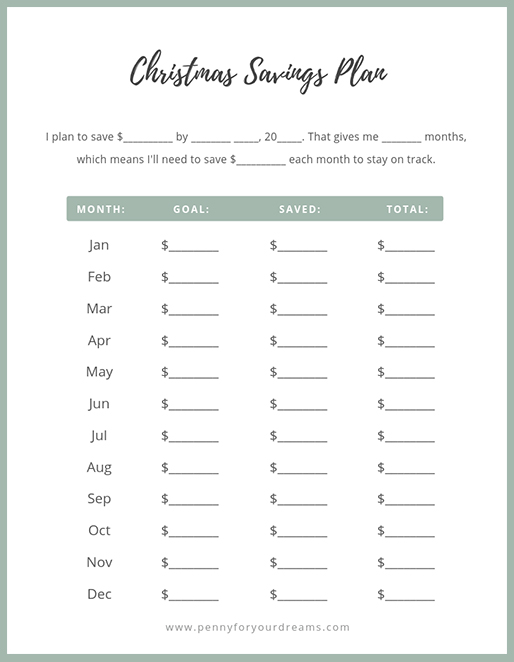

Christmas Savings Plan – FREE Printable!

Before we talk about how you can cash flow Christmas, I want to give you a copy of the Christmas Savings Plan I created. It’s a super easy way to track your Christmas savings!

The Christmas Savings Plan is a completely customizable savings tracker, so you can write in exactly how much money you want to save—and how much time you have left.

I’ve also included an example sheet in the PDF to help you get started!

The Christmas Savings Plan is a totally free printable, found on pages 4-5 of The Merry Little Christmas Planner, which you can download from my Free Resource Library!

Go ahead and sign up down below. Once you’ve signed up, you’ll also gain access to all of the other freebies in my resource library!

woot.

How To Have a Debt-Free Christmas

Cash flowing Christmas isn’t rocket science, but it does take intentionality, especially if you’re on a tight budget.

Our budget in YNAB has a line item specifically for Christmas savings. Starting in January, we try to set aside a predetermined amount each month so that Christmas doesn’t sneak up on us.

But really… how could it? Christmas comes at the same time every year!

1. Start Saving for Christmas in January

When you start saving for Christmas in January, you have the option to save for Christmas little by little.

It’s a smaller amount out of your paycheck every month, which makes cash flowing Christmas feel more manageable.

If you try to start saving for Christmas in October—and also have a car repair and an unexpected dental bill in the same month—you’ll have a harder time finding the extra cash.

Starting earlier in the year allows you to have more flexibility. During the months you have higher expenses or less income, you can’t put as much into your Christmas fund, and vice versa.

By the time the holidays arrive, you’ll be ready! You won’t be scrambling to find a few extra dollars here and there—and you won’t need to max out any credit cards!

You’ll be prepared.

2. How Much Money Should You Save for Christmas?

Now, you’ll need to figure out how much money you want to save for Christmas.

Unless you’ve kept good records of how much you’ve spent on Christmas related purchases in past years, it’s difficult to come up with an accurate number.

Sit down and make a list of your typical Christmas expenses. Then, estimate how much you want to spend on each item. Each family will have their own priorities for their Christmas fund—a fresh Christmas tree, giving to those in need, home decor, gifts, Christmas cards, fun activities, special food, parties, etc.

For the past few years, our Christmas budget has been between $600-$750, and that total includes most of the items on that list. But this Christmas, we’re hoping to spend closer to half of that amount!

This year, we’re planning a very simple Christmas season because most of our extra money is currently going toward building our house.

Your spending should align with your priorities. It’s perfectly fine to spend less on Christmas some years, and more on others.

Please don’t go into debt because of other people’s expectations! There are plenty of creative gifts you can give that are inexpensive or don’t cost a dime.

If you need to tell your family that you’d prefer to not exchange gifts this year—or that you’re giving homemade gifts instead—there’s no shame in that!

But DO tell them ahead of time so that there aren’t any surprises on Christmas day.

Doing a family gift exchange is another great idea. Everyone draws names and you can and set a limit on how much each person should spend. Giving one really nice gift is often more cost-effective—and simpler—than trying to find a bunch of small gifts for everyone!

This works especially well for larger families like my husband’s. Now that there are several married couples and lots of grandkids, it’s impossible to give everyone a gift. We do our gift exchange Secret Santa style, which adds a fun element of surprise!

Giving your time and talent can really bless someone else. Maybe you’re a pro at decluttering and organizing, an amazing baker, or a trustworthy babysitter. Oftentimes, people appreciate intangible gifts because they don’t have to find a place to store it in their home!

Keep the season centered on Christ, and everything else will fall into place.

3. Divide and Conquer

Now that you know how much you need to save for Christmas, simply divide the dollar amount by the number of months you have left to save.

For instance, if you save $50 each month from January to December, you’ll have a whopping $600 to spend on Christmas!

If you save $100 each month from July to December—six months—you’ll also have $600 to spend on Christmas.

Once you put money into your Christmas fund, leave it there! Resist the temptation to use it for something else. You’ll thank yourself when Thanksgiving rolls around!

And don’t feel discouraged if you only have a few months left to save!

Try raising the money for your Christmas fund by having a garage sale or selling unwanted items on OfferUp or Facebook Marketplace. Autumn is a great time to declutter since there’s always an influx of stuff around the holidays!

If it’s already almost Christmas, you can always start saving toward next Christmas once January rolls around.

Download Your FREE Christmas Savings Plan!

Don’t forget to download your FREE Christmas savings plan, included on pages 4-5 of The Merry Little Christmas Planner!

How much do you typically spend on Christmas?