How much should you budget for Christmas gifts?

How can you shop for everyone on your Christmas list without going into debt?

What can you do to stop overspending during the holiday season?

I’m glad you asked!

Today, we’re going to talk about exactly that.

Buying gifts for family and friends is such a joy, and it’s easy to get carried away! But if we have a plan in place ahead of time, we can set worry aside and simply enjoy the gift-giving process.

When to Budget for Christmas Gifts

Fall is a great time to start planning for the Christmas season! It gives you a buffer before jumping into Christmas the day after Thanksgiving.

This is especially true when Thanksgiving falls late like it does this year. Thanksgiving is on the 28th, which will leave us with less than one month ’til Christmas!

Personally, I like to budget for Christmas gifts in October.

The planning process feels calm and relaxed, and it helps me to keep my eyes out for great deals leading up to Black Friday and Cyber Monday!

Budget for Christmas Gifts in 5 Easy Steps

This simple, 5-step process will take the guess-work out of how to budget for Christmas gifts!

If possible, I highly recommend working through these pages with your spouse. You’ll each have your own great ideas to add which will provide valuable insight!

I’d also recommend using a pencil for these exercises—at least for the first draft. That way, you can easily tweak numbers as needed.

I designed 5 pages in The Merry Little Christmas Planner to help you accurately budget for Christmas gifts:

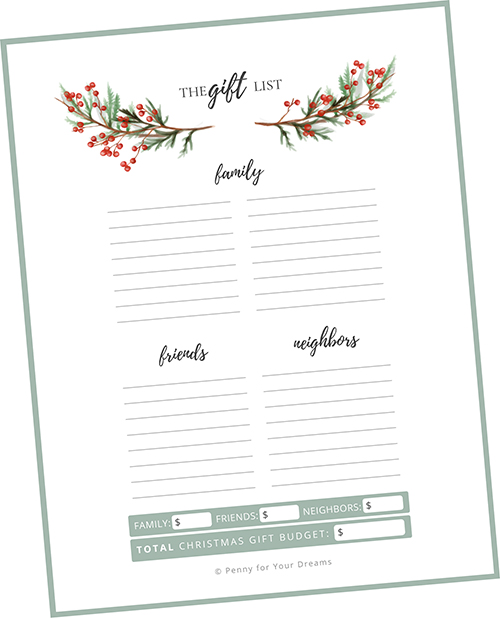

- The Gift List

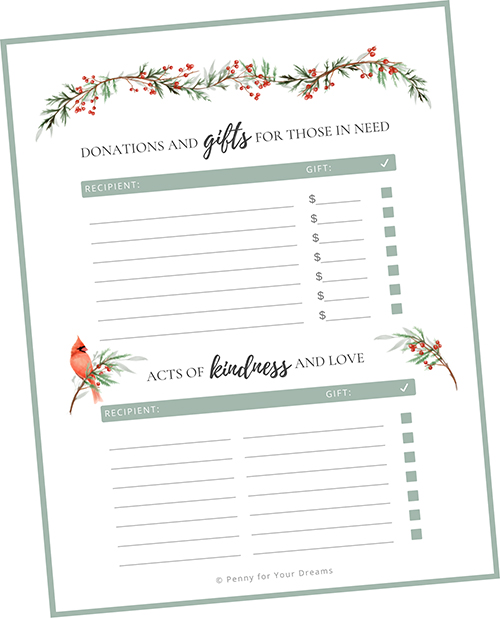

- Donations & Acts of Kindness

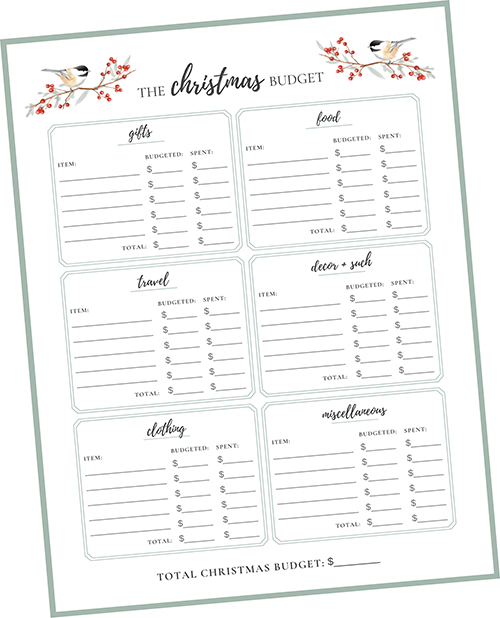

- The Christmas Budget

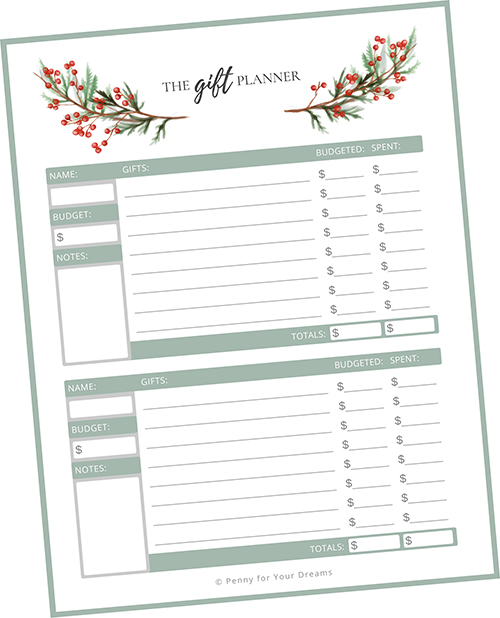

- The Gift Planner

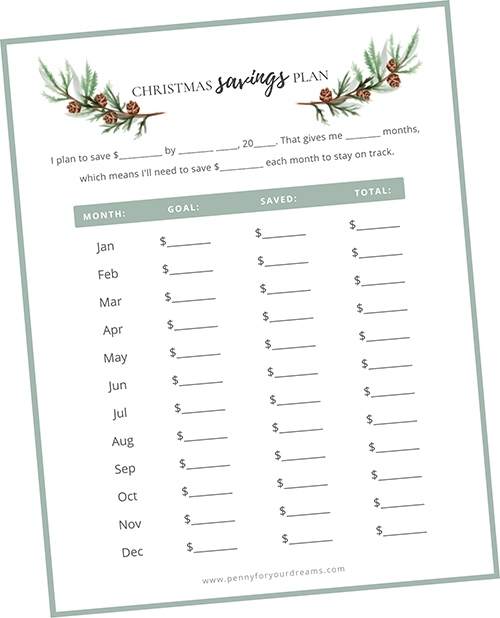

- Christmas Savings Plan

(You can also use plain paper for these exercises if you’d prefer, but the planner makes your life a little easier!)

If you’ve already signed up and received the password, head on over to the FREE Resource Library where you can download your free copy!

If you haven’t signed up yet, simply fill out the form below to receive your copy of The Merry Little Christmas Planner!

Step 1: The Gift List

The first step in budgeting for Christmas gifts is deciding who you want to buy for!

Using The Gift List on page 8 of The Merry Little Christmas Planer, write down everyone you plan to give gifts to this year—your kids, your spouse, yourself (if your spouse will be buying for you), extended family, friends, teachers, pastors, neighbors, babysitters, co-workers, a secret Santa recipient, etc.

Try to be as thorough as possible.

And remember—you are certainly not obligated to buy for everyone in your life! It’s perfectly fine to keep your Christmas list small.

Even if you simply plan to gift someone with homemade treats or a small $5 gift, write that person down!

These gifts will still cost you something.

You’ll notice that there are blanks with dollar signs at the bottom of your Gift List sheet, but don’t fill them in just yet!

Step 2: Donations & Charitable Giving

Charitable gifts should be considered ahead of time so that they don’t become an afterthought. By mid-December, you might not have much extra money to spare.

The Donations & Acts of Kindness sheet can be found on page 11 of The Merry Little Christmas Planner.

Jot down any churches, ministries, charities, organizations, or families you feel led to give to this year.

For now, leave the column blank where you’ll fill in gift amounts.

Step 3: The Christmas Budget

Next up, we’re going to take a look at your entire Christmas budget!

The Christmas Budget sheet can be found on page 6 of The Merry Little Christmas Planner.

You’ll inevitably think of things to add to your Christmas budget as the holiday season approaches, so creating it ahead of time provides you with margin.

(Now would be a great time to plan out your entire Christmas budget if possible. But if you currently have limited time, you can just focus on the “Gifts” category for now.)

Let’s talk about the 2 ways you can approach budgeting for Christmas:

1. The Top-Down Method

This method usually works best if you know (roughly) how much you usually spend on Christmas.

It’s also a good method if you’re on a tighter budget and you’ve decided that you want to spend no more than, say, $600 on Christmas this year.

Start by writing down the total amount you plan to spend on Christmas this year at the bottom of the page in the “Total Christmas Budget” section.

Next, try breaking that number down into the different categories and go from there. This is where using a pencil comes in handy!

When setting your gift budget, be sure to consider the people you wrote down in Step 1 and Step 2.

Tweak your numbers until the amounts for each category seem realistic and well-balanced.

Check out our $400 Christmas Budget Breakdown here if you’re looking for an example of a shoestring Christmas budget!

Just remember that every family’s priorities for the Christmas season will look a bit different. Do what works best for you and yours!

2. The Bottom-Up Method

Another approach you can take is to start with each category and work your way up toward a total.

Go through the categories one by one and estimate how much you want to spend on each.

This method works best when your budget is a bit more flexible—or if you’re unaware of how much you typically spend on Christmas!

If this is you—don’t panic!

You can always go back and lower your budget numbers later if the Christmas budget total seems too high.

The “bottom-up method” can act as a helpful starting place.

Let’s use the “Clothing” category as an example.

Maybe you love buying matching Christmas pajamas every year. Or perhaps your child needs a costume for a Christmas play. Or let’s say you’re planning coordinating outfits for a special Christmas picture and need to buy a dress, a sweater, and some shoes to finish everyone’s outfits.

Write down each expense on a separate line in the “Item” column. Then estimate how much they’ll cost in the “Budgeted” column.

Then, once you’re finished estimating expenses for the clothing category, add the numbers in this column together and write the total down in the “Total” space.

Do this for each of the 6 different categories on your Christmas Budget sheet. Then add the 6 “Total” amounts together.

Write that number in the “Total Christmas Budget” section at the bottom of the page.

Again, this can simply act as a helpful starting point.

If the total you end up with seems too high, you might need to go back and adjust your budget numbers or cut out a few things.

Print out another sheet if you need to!

Step 4: The Gift Planner

In Step 3, we settled on a total budget amount for gifts.

In Step 4, we’ll be breaking down that number between every person on The Gift List and everyone listed on your Donations & Acts of Kindness sheet (from Steps 1 and 2).

We’ll be using The Gift Planner sheets found on pages 9-10 of The Merry Little Christmas Planner.

I designed The Gift Planner to help you budget and keep track of gifts for everyone written on your Gift List.

The Gift Planner on page 9 contains 2 larger planning sections for family, and The Gift Planner on page 10 contains 3 smaller planning sections for friends and others.

Print out as many sheets as you need!

Right now, we mainly want to fill out the “Name” and “Budget” sections (left column). But feel free to jot down gift ideas and how much they cost if that helps you to figure out how much you want to spend on each person.

(Don’t forget to consider stocking stuffers!)

You’ll also want to look at your Donations & Acts of Kindness sheet again. Considering your total gift budget, write down donation amounts in the “Gift” column.

Once you’re finished filling out The Gift Planner sheets and your Donations & Acts of Kindness sheet, add up all of the amounts you wrote down.

Hopefully, the total is less than (or equal to) the number you wrote down on your Christmas Budget sheet.

If not, simply go back and tweak your numbers—or raise the Christmas gift budget if need be. Just make sure you’ll still be able to pay cash for everything.

Be realistic and honest with yourself!

Step 5: A Christmas Savings Plan

Alright, we’ve set the groundwork for your Christmas budget. Now we just need to make sure we have enough money saved!

You can find The Christmas Savings Plan and corresponding example on pages 4-5 of The Merry Little Christmas Planner!

I wrote an entire post about how to create a Christmas savings plan and have a debt-free Christmas, so I’ll let you go read that post instead of rewriting it here:

How to Have a Debt-Free Christmas | Create a Christmas Savings Plan

Commit to a Debt-Free Christmas

Now for a little tough love…

If you want to have a debt-free Christmas, it’s important to not only save enough money ahead of time, but to actually stick to your Christmas budget!

A budget is useless if you don’t take it seriously.

If you set aside $500 for gifts, then don’t spend more than $500 on gifts!

It can be really hard to say “no” in the moment, but you’ll thank yourself later. Your New Year will be off to a much better start without Christmas debt hanging over your head!

If you don’t trust yourself with a credit or debit card, try only bringing cash when you go Christmas shopping. This obviously doesn’t work with online shopping, but it’s a start!

It’s easy to go overboard shopping for Christmas gifts—trust me, I’ve been there! But the last thing we want is to get a little too caught up in the spirit of Christmas and end up with credit card debt in January.

By all means, give—and give generously!

But do so within your means.

By thoughtfully planning ahead—and practicing some self-discipline—we can enter the New Year without any Christmas debt hanging over our heads!

Give yourself that gift.

thanks